Hardship Exemption Clause 18

Learn more about the hardship personal tax exemption clause 18.

The hardship exemption is discretionary. You may be eligible for this exemption if the Board of Assessors determines you can’t pay your real estate taxes because of your age, infirmity, and financial condition. Eligible taxpayers may be released from paying all or a portion of their real estate taxes.

Eligibility

A Board of Assessors member will determine if a home inspection is necessary. If you refuse the inspection, your application will be denied. All multifamily or mixed-use buildings will require an inspection.

Applicants must possess an ownership interest in the property worth at least $4,000. Contact the Taxpayer Referral and Assistance Center (TRAC) for more information about the ownership requirement.

Other Eligibility Requirements

- You were called into active military service (not including initial enlistment, or

- you are older and suffer some physical or mental illness, disability, or impairment.

Note: Upon applying for a financial hardship exemption, you may be required to provide the assessors with further information and supporting documents to establish your eligibility. Qualifications are established locally by the board of Assessors.

Apply for a Personal Exemption

Applications must be filed by April 1 of the current fiscal year.

If you have questions about the requirements for applying for an exemption, or want to know the status of your application, you can call the Taxpayer Referral and Assistance Center at 617-635-4287.

Please note: A Fiscal Year takes place from July 1 through June 30 of the following year. For example, Fiscal Year 2025 (FY25) would be July 1, 2024, through June 30, 2025.

Complete your application

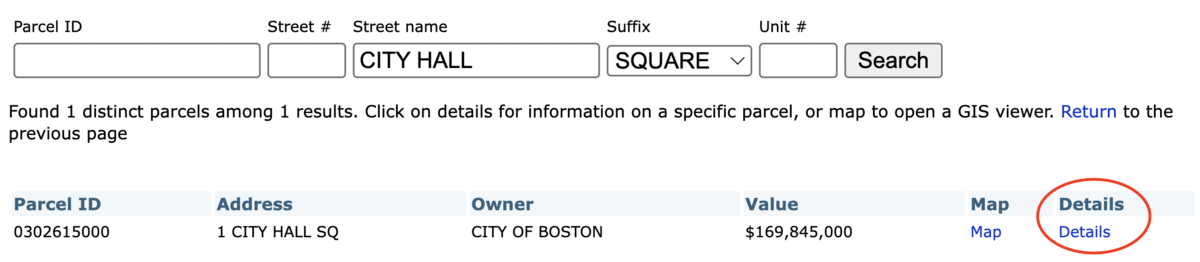

Applications can be downloaded after we issue third-quarter tax bills in December. To download an application, search for and find your property using the Assessing Online tool, then click the "Details" link:

The link to the application will be under the "Abatements/Exemptions" section. For more information on what's possible with Assessing Online, visit our explainer page.

You can also get an application by calling the Taxpayer Referral and Assistance Center at 617-635-4287. Applications can also be completed at City Hall. Remember to bring any additional documents you need for your exemption application.

Submit your application

Bring or mail your completed application and supporting documents to the Assessing Department at City Hall:

ASSESSING DEPARTMENT, ROOM 3011 CITY HALL SQUARE

BOSTON, MA 02201

Required Documentation

Together with your application you will need to provide the following information:

- Birth certificate

- Your most recent tax returns with your W2 forms, or copies of your pay stubs for the last year

- Social security benefits statement

- A statement detailing your pension benefits

- All bank statements for the current and previous year

- What you receive in unemployment compensation

- Any public assistance statements for the current and previous year

- What you receive from rental income

- All sources of income you receive, including money you get from non-family members who live in your home, and any financial help you receive from your adult children

- The names and ages of any minors who live in the home, and the school they attend

- The names, dates of birth, addresses, jobs, and wages of all of your children 18 years or older

- Monthly, quarterly or yearly statements for any IRAs or annuities that you hold

- a current physician's letter detailing your disability and how long you've had it

- Copies of your utility and food bills, mortgage payments, credit and loan payments, and car and house insurance

Exemption Frequently Asked Questions

Frequently Asked QuestionsThrough an exemption, the City releases you from paying part or all of your property taxes.

We will send you a renewal application, but it's still your responsibility to make sure that you file a renewal each year.

The Taxpayer Referral and Assistance Center (TRAC) has three months from the date on which the application was filed to determine the merits of the application.

Approved exemption applicants can expect to see the personal exemption applied to their third-quarter tax bill that will be issued in late December.

If an exemption is denied you will receive a notice of denial in the mail.

If the application is denied, you may file an appeal with the Commonwealth of Massachusetts Appellate Tax Board (ATB) within three months of the date that the denial decision is made. The ATB is located at:

100 CAMBRIDGE STREET2ND FLOOR, SUITE 200

BOSTON, MA 02114

The ATB can be reached by phone at 617-727-3100.